TL;DR

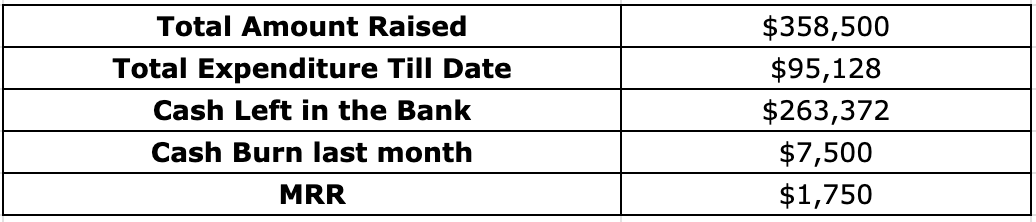

- Financials: Here is the updated snapshots of the financials

- Last Sprint: We converted the 2 pilot customers into paid customers last month. Decided to focus only on US SaaS companies in their growth stage (Series B onwards) targeting Product and Engineering leaders. On the product front, we developed a clarification layer that asks follow-up questions to confirm the ask, created a multi-agent framework to execute complex queries, and shipped the V1 to enable self-serve onboarding for customers

- Current Sprint: Aim to convert one 1 US-based SaaS company as a customer who is in their growth stage (Series B+), Validate the custom reporting and insights use case for US-based SaaS, Build and mature product capability for the existing customers, Experiment with Open Source LLMs (Llama 2)

- Help Needed: Understanding the right metrics and goals to raise a seed round, connects with GTM leaders in the US for selling to mid-market SaaS companies

DEEP DIVE

Progress from Last Sprint:

GTM

We chose SaaS companies in India/US serving US enterprises as a target profile since we believe they are great early adopters of new tech and may already be exploring use cases internally

For the first 2 weeks, we focused on CXOs, VPs, and Directors of Product & Engineering in these companies. We cold-reached out and spoke to 75+ of them to understand their roadmap and priorities and validate whether a ‘high volume of custom reports & insights’ is a pain point for them

We focused mainly on LinkedIn and the response has been great. ~10-20% of messages convert to a call and ~15-20% of calls show intent to try a personalized demo (depending on the sector/stage). We have now begun experiments with Email outbound

Learnings:

We got great response from Indian SaaS companies (2 of which converted to paying customers). They are aggressive enough to help us build the right product & consume our tech bandwidth

We think it makes sense to switch gears and focus only on US-based SaaS from now on. Hence, we have decided to focus on the quality of customers over quantity and are only targeting US-based SaaS cos in their growth stage (Series B+ or $10M+ ARR)

The Product & Engineering leadership is most receptive to our pitch. Companies who have already put GenAI applications on their roadmap or have tried POCs internally are most receptive to Crux. We will be using this as a filter to locate high-intent

We’ve spoken to 10+ SaaS co who are unsatisfied with their existing analytics tools (either legacy tools like Looker, PowerBI, etc., or self-made ones) and are trying to solve this internally through a POC using LLMs. Some others have added this to their roadmap for the next quarter. We are now trying to understand whether they want to build this internally or prefer to buy Crux

Existing Customers

Here is a summary of our interaction with the 2 paying customers:

Leucine has already decided to replace Amazon Quicksight with Crux in its core product offering. This has created significant upsell opportunities for one of the clients and are scheduling demos with their end customers.

Both of them have done a media PR on what we are building with them.

//Pixis mentioned NLP-based analytics in the fundraise announcement on TechCrunch

Product:

R&D

Introduced Clarification Layer which asks clarifying questions from users to fully understand the user intent while asking a particular question.

Experimented with 30+ tables and have achieved 95% accuracy. There are going to be challenges with increasing the number of tables as 32K is the context token limit. We have plans to experiment with open-source LLMs like Llama-2 for higher token limit and more control.

Onboarding & Connectors:

Customers have connected their own database without us interfering. This is the first step in making our platform self-serve and scalable

We are adding connectors as required. We built a Google Sheet Connector to directly link any sheet or groups of sub-sheets to the Crux engine and start interacting with it. This also helps us spin up instant demos for prospects

Features & Capabilities:

Save as Widget: Customers have the option to save the output in the form of widgets

Use Crux as an API or Embedding: We have created and shipped APIs for our entire platform which can be used to create different experiences at the customer's interface (UI) or can be embedded as a complete section in the product

On-premise: We deployed our code onto both the customer’s on-premise server

Ability to annotate: added option to allow users to give more context about their table and context. This helps in improving the overall accuracy of the platform.

Recent Hires:

Engineers: Onboarded two engineering interns (a 3rd-year Computer Science student from IIT Bombay and a final-year student from IIT Dhanbad)

Sales & Marketing: Onboarded one intern from IIT KGP (has a PPO from LEK Consulting and has worked as a PM intern for 1 year with a SaaS startup)

Design: Onboarded one full-time design member - Parth. Parth is a graduate of DU and has interned at various early-stage startups and was part of the 10k designer cohort. He comes with a strong referral from one of our angel investors whom he has worked with in the past

Focus for Current Sprint:

Sales & Marketing:

Focusing on native US-based SaaS companies and onboard 1 US SaaS company in the growth stage (Series B+ or $10M+ ARR)

Engage with existing leads, help them navigate the exact use case and how Crux can fit into their workflow

Experiment with a new set of channels (LinkedIn content, product launch platforms, email outbound)

Product & Engineering:

R&D:

Enable interaction with multiple databases to answer a question

Experiment and implement Open Source LLMs like Code Llama

Experiments to solve for LLM context limit challenge when integrating with larger databases

Onboarding & Connectors:

Integrate more data connectors as per customer needs - starting with MongoDB

Features & Capabilities:

Improve the graphical visualization and option to interact with the graph via chat

Option to add business-specific keywords give LLMs more context

Hiring:

Full-Time Engineers: We are looking to hire two founding engineers to assist Prabhat in the development stage.

Product: One product intern to create product specs, perform QA, and assist in executing product roadmap.

Unknowns to be answered:

Should we focus on specific industries or should we build a horizontal offering? Will a horizontal offering be scalable when we start providing insights & actionables in addition to the chat-based analytics?

Our existing customers are consuming most of our tech bandwidth and it seems difficult to engage with more than 3-4 customers. Should we only work with a select few quality customers for the next 3 months or should we focus on increasing headcount to onboard more customers?

Should we give access to our internal tool which we created to experiment with LLMs (Ferrous) to our customers? They have shown great interest in using that platform. Or could it be monetizable later?

What milestones should we set for the seed round? Should the primary focus be on MRR or usage or quality of customers?

Help Needed:

Brainstorming:

Setting up milestones for the seed round

How to influence decision-makers in their build vs buy dilemma

How to divide focus between sales & marketing efforts

Connects:

With founders & GTM leaders/advisors to help us navigate the US market

With founders or product & engineering leaders of mid-market ($10M - $100M ARR) SaaS companies in your portfolio